current location:Home>>Activity details

Co-organizer:

| Time/Date | 10:00am - 13:15pm., Thursday, August 30, 2012 |

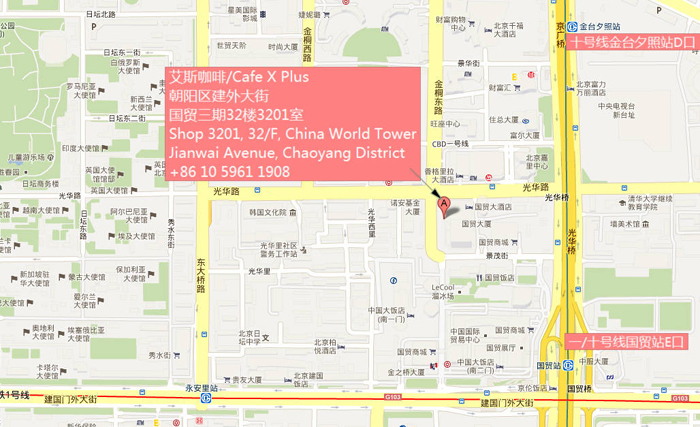

| Venue | Cafe X Plus, Shop 3201, 32/F, China World Tower, Jianwai Avenue, Chaoyang District (+86 10 5961 1908) |

| Participation Fees | Free to CVCA and YVCC members |

| Language | English (On-site brief Chinese translation support will be provided) |

| Registration contact | Linda Li: 8610 8518 3584-813 Lee@cvca.com.hk Ning Sun: 8610 8518 3584-816 ning@cvca.org.cn |

Multinational companies are facing a slow and difficult recovery in their domestic markets, whereas Asia and in particular China, offers exciting growth opportunities to put their cash to work. Contrasting with the situation prior to the global financial crisis, where a China presence was a “nice to have”, for many businesses it has now become an urgent strategic imperative. Now, sitting on large cash reserves and with ample borrowing capacity, these companies are looking at acquisition opportunities in China. Likewise, cash-rich Chinese companies that have benefited from years of domestic economic growth look west in search of new technology and sales opportunities.

When acquiring shares or assets, the parties to a cross-border M&A transaction often find themselves locked in heavy negotiations over the warranties and indemnities within the sale contract. A major part of these negotiations revolves around the identification and treatment of various risks within the target company. Both parties seek to minimise their exposure to risk to commercially acceptable levels whilst ensuring this does not adversely impact the value of the asset and their chances of completing the deal. These negotiations can become extremely difficult and most deal professionals are aware of examples where this has lead to the deal collapsing.

In this seminar, seasoned risk and insurance professionals from Marsh will present and discuss their respective experience and perspective with respect to the legal framework and specific solutions the insurance industry has developed for both buyers and sellers to enable deal risk to be effectively priced and transferred to a warranty and indemnity contract.

Agenda:

| 09:45 – 10:00 | Registration |

| 10:00 – 10:20 | Opening address, Michael Turnbull, Chartis |

| 10:20 – 11:45 | Cross Border M&A Risk Transfer Solutions, David Holiday, Marsh |

| 11:45 –12:00 | Essential Due Diligence in Cross Border M&A Antony Butcher, Marsh |

| 12:00 – 12:15 | Q&A |

| 12:15 – 13:15 | Lunch |

The above agenda is subject to change. CVCA will notify you of any updates in the program.

Seats are limited. Please make an early reservation. Registration on site is not available.

SPEAKERS:

David Holiday, Head of Transactional Risk, Asia - Marsh Hong Kong

David is the Head of Transactional Risk, Asia, for Marsh's Private Equity and M&A Services practice (“PEMA”) located in Hong Kong. David's principal responsibility is leading PEMA's strategy for transactional risk insurance in Asia including advising, structuring and executing transactional risk transfer products for financial and strategic investors with a focus on warranty and indemnity insurance.

Antony Butcher, China Practice Leader - Marsh China

Antony is the China Practice Leader for PEMA based in Shanghai. Antony's principal responsibilities include client advocacy in cross-border M&A through the leading and delivery of pre-acquistion insurance due diligence and post-acquisition portfolio initiatives for private equity and corporate clientele.

Michael Turnbull – Mergers & Acquisitions Manager, Chartis

Michael is a solicitor who is qualified in both England & Wales and Hong Kong. In 2003, Michael received a BA in Accounting and Law from the University of Manchester. After completing his legal practice course at the College of Law, Chester, Michael was a trainee solicitor and then corporate lawyer at large international law firm in Manchester. Michael relocated to Hong Kong in 2008 where he continued to specialise in advising on M&A and private equity transactions. He joined Chartis in September 2011 as Mergers & Acquisitions Manager for China and Southeast Asia.

Map:

About China Venture Capital and Private Equity Association (CVCA)

Founded in 2002, China Venture Capital and Private Equity Association ("CVCA") is a member-based trade organization established to promote the interest and the development of the venture capital ("VC") and private equity ("PE") industry in the Greater China Region. Currently CVCA has more than 100 member firms, which collectively manage over US$500 billion in total AUM. CVCA members are representatives of the most seasoned PE/VC investors and service providers who have experienced global economic cycles. The members have made many successful investments in a variety of industries in the Greater China Region. CVCA is dedicated to promoting the progress and the healthy and sustainable development of venture capital and private equity in China market.

More information about CVCA, please visit www.cvca.org.cn.